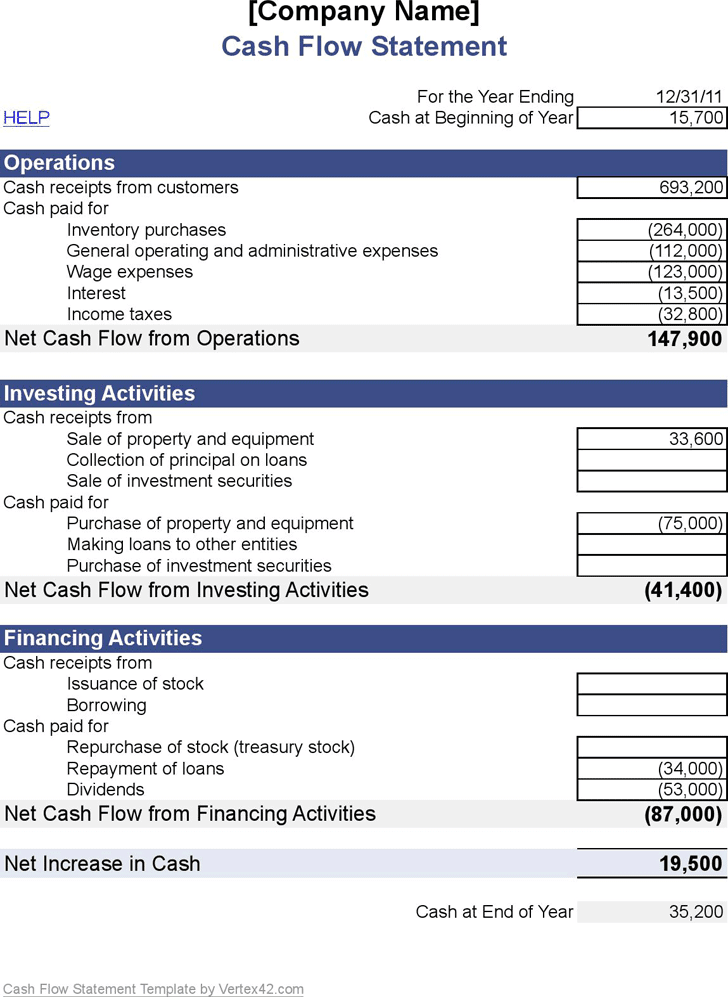

The cash flow from operating activities covers the enterprise’s key revenue-generating activities as well as other non-investment and non-financing activities. Think of it this way, the receipt of cash from a non-cash item would be termed as cash inflow and the cash payment in respect of such items would be termed as cash outflow.įinancial Statements of a Company Classification of Business ActivitiesĪs per the chapter of Cash Flow Statement class 12 and the Accounting Standard-3 (revised), the changes that are resulting in the inflows and outflows of cash and cash equivalents are classified into 3 business activities namely: Cash Flow from Operating Activities In other words, it can be explained as the movement in and movement out of cash and cash equivalents. What are Cash Flows?Īs per the chapter on Cash Flow Statement class 12, cash flows are referred to as the inflows and the outflows of cash and cash equivalent in a business. On the other hand, cash equivalents are described as short-term highly liquid assets that are readily convertible into known amounts of cash and have a low risk of value change. Cash vs Cash EquivalentĪccording to the chapter on Cash Flow Statement class 12, Cash is divided into two categories which are cash in hand and demand deposits with the bank.

CASH FLOW STATEMENT ACCOUNTS HOW TO

And for practical issues where the guidance remains unclear, we offer our position on how to classify many of these cash flows.As per the chapter of Accountancy on Cash Flow Statement class 12, a cash flow statement refers to a statement showing the cash inflows and outflows or the financial position of a business during different intervals of time in terms of cash and cash equivalents.Īll publicly listed entities have to prepare and report a cash flow statement along with other financial statements on an annual basis under the New Accounting Standard-3. We’ve organized it by transaction type, making it easier to identify the answers to the common and not so common questions that you may have. This Handbook provides an in-depth look at statement of cash flows classification issues and noncash disclosure requirements. Rather than waiting for scrutiny this is a good time for entities to revisit the ‘how-tos’ in preparing the statement of cash flows. As the FASB and SEC focus on providing evermore useful information to financial statement users, they have specifically mentioned the statement of cash flows as a way to provide that information. Therefore, diverse presentation practices remain.Īgainst that backdrop, the statement of cash flows is coming into the spotlight again.

CASH FLOW STATEMENT ACCOUNTS SERIES

Yet, there has not been significant standard setting in this area since 2016 when the EITF clarified a series of classification issues and changed the presentation of restricted cash and cash equivalents. This is even true for transactions that do not involve cash. This complexity is compounded by the fact that every transaction recorded through the financial statements needs to be assessed for its impact on the statement of cash flows. The composition of cash and cash equivalents also often raises questions. But identifying the appropriate activity category for the many types of cash flows can be complex and regularly attracts SEC scrutiny. Cash flows are classified as either operating, financing or investing activities depending on their nature.

The underlying principles in Topic 230 (Statement of Cash Flows) seem straightforward. Potentially misunderstood and often an afterthought when financial statements are being prepared, it provides key information about an entity’s financial health and its capacity to generate cash.

The statement of cash flows is a central component of an entity’s financial statements. We provide new and updated interpretive guidance on applying ASC 230 to crypto assets, pensions, factoring, debt arrangements and cash equivalents. We explain cash flow classification issues and noncash disclosure requirements in detail.

0 kommentar(er)

0 kommentar(er)